10 Min. Read

The New Consumer Mindsets: Inspire & Inquire

The consumer funnel is f*cked; now, a simpler, more relevant consumer framework has emerged. Social media has given rise to two distinct yet intertwined mindsets: Inspire & Inquire.

Zs meander in and out of Inspire and Inquire mode, moving from flashes of influence to detail-oriented deep dives on brands and products and back again. While the funnel of yore placed brands at its center — tracking consumers proximity to purchase — these two mindsets reflect how Gen Zs really navigate the world, and where, how, and why they embrace brands along the way. Understanding them is a must for brands that want to win with Zs.

Inspire Mindset

First, the Inspire mindset. Zs live and breathe inspiration. When asked what is most fundamental to who they are, Zs are most likely to say “Inspired: I’m constantly finding inspiration in the things around me” (compare that with Millennials, who are most likely to say “Practical: I make responsible choices”). And for Zs, social media is their inspiration oxygen supply: 62% of Zs say that with so much content available, they’re often inspired — while just 38% say the abundance of content makes it harder than ever to feel inspired.

As a result, Zs are constantly on the hunt for new inspiration. Consider that 84% of Zs seek out new music at least weekly (and 25% do so hourly), while 66% are doing weekly digs for cultural content and 56% for new style inspiration. This craving for constant inspo extends to brands too: 71% of Zs agree, “I’m always open to discovering new brands,” and 57% are actively seeking new brands at least weekly. Amazon has tapped into this mindset with the recent launch of it’s “TikTok-like shopping feed” called Inspire, which offers users the chance to, well, get inspired – they can find what they didn’t even know they were looking for.

This Inspire Mindset is a powerful one – it’s the inception point of Zs’ path to purchase. As Lucy Maguire, senior trends editor at Vogue Business, tells us, a study from BCG found that 70% of young people decide to purchase at the point of inspiration. But there’s an important distinction to be made here: “That doesn’t mean that [consumers] are purchasing at the point of inspiration,” she says. “They might make the decision, but then they go away and they do their research — and they won’t take it lightly.” There’s another consumer mindset to consider too: Inquire.

Inquire Mindset

Once Zs’ inspiration has been sparked, they shift into a wholly new mode: inquiry. In this headspace, they’re incredibly savvy. They want the nitty-gritty details stat — the price, the fit, the materials, the mechanics. They’re looking for credible data from brands, and beyond — seeking out trustworthy info to give them confidence that what they’re buying is exactly what they need. This is their Inquire Mindset, and they won’t click “purchase” until all their lines of inquiry have been satisfied.

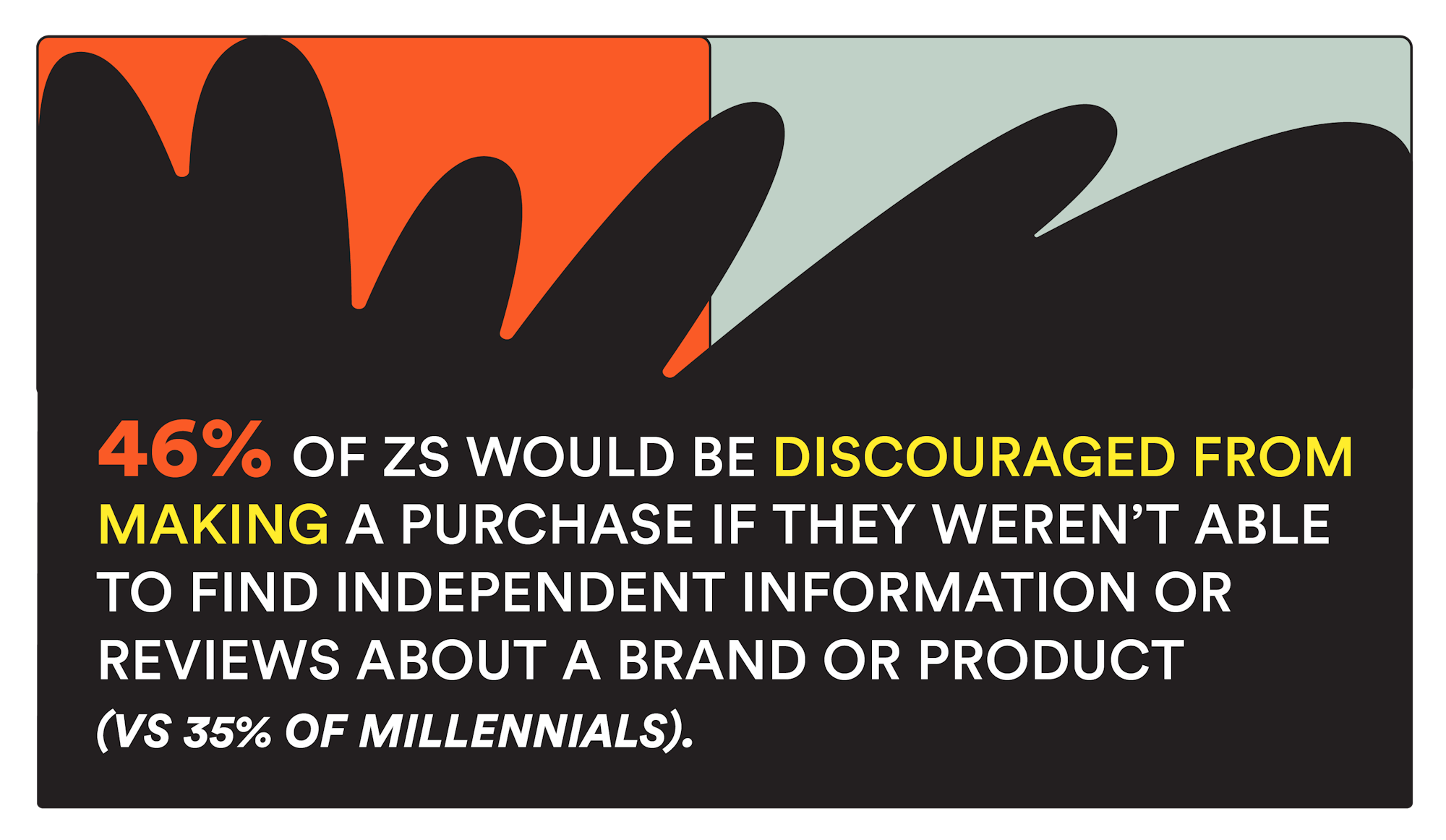

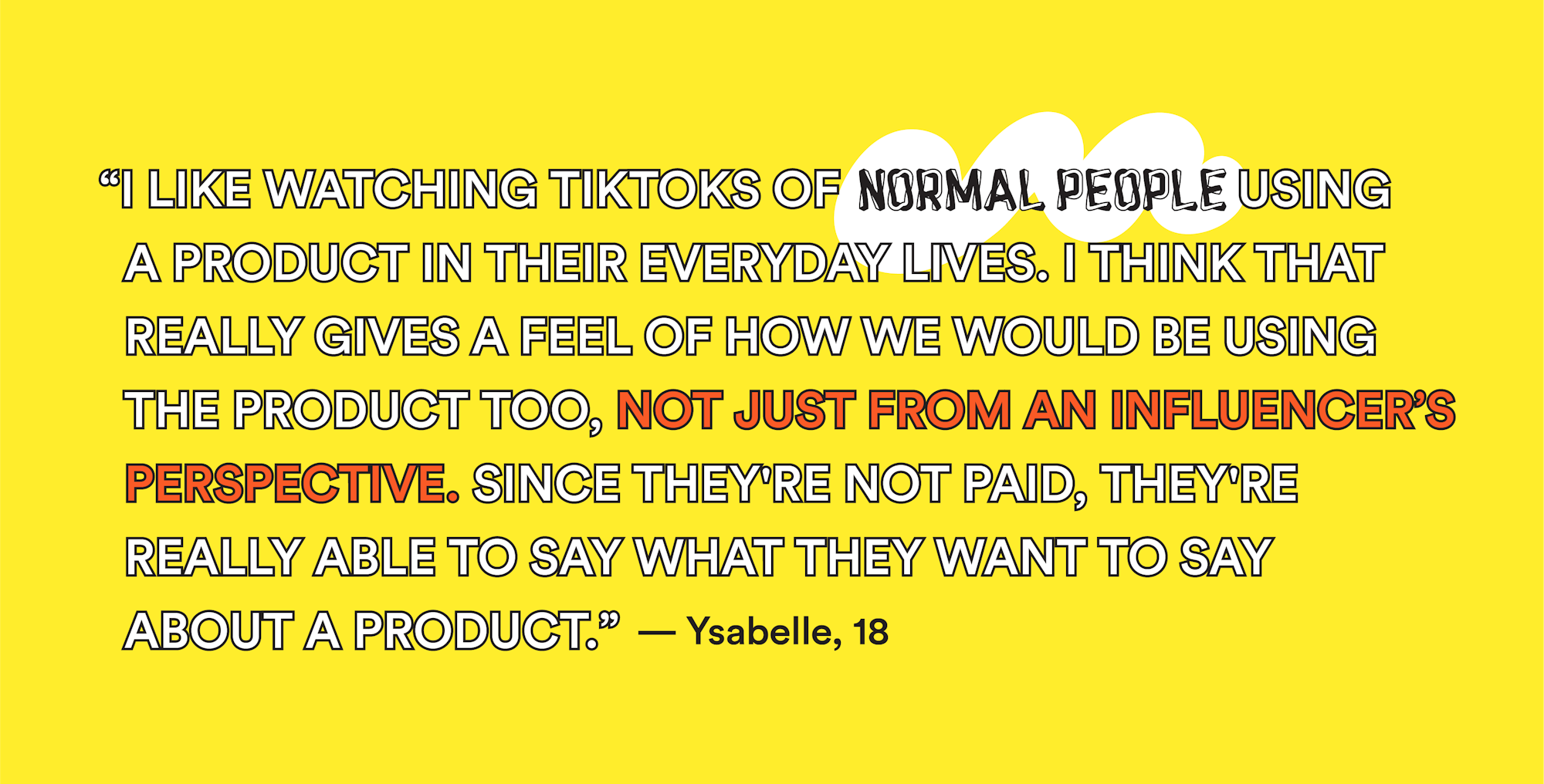

Marketers might think this is the moment they flock to a brand website to scan product stats — but that’s not necessarily next for Gen Zs. More than half (56%) of Zs agree, “brands often lie about their products/services,” and just 40% say they trust brands’ claims about their products/services, compared to 58% of Millennials. (By the way, Zs increasingly see online influencers with hundreds of thousands or millions of subscribers as similarly untrustworthy like big brands.) This distrust of marketing institutions fuels the intensity of Zs’ inquiry, as they put their faith in real people — perhaps quickly scanning a brand website, but then checking the comment section of creator’s posts to see what random strangers have to say about a product.

While in this Inquire Mindset, Zs’ craving for inspiration is on the back burner. In fact, the worst thing a brand can do is hit them with narratives around purpose, story, beliefs, or pure aesthetics. In our research, Zs told us that rather than entertaining content, in this moment their primary need is for a brand to “just tell me why your product is good.”

The New Search

Fueling Zs’ Inquire Mindset are the very same channels where they also find their inspiration: social media — only now as a tool for deep research rather than random scrolling. While Millennials still go to Google to research potential purchases, TikTok is the new search engine for Gen Z. Even Google execs admit it: “Almost 40% of young people, when they’re looking for a place for lunch, they don’t go to Google Maps or Search. They go to TikTok or Instagram,” Prabhakar Raghavan, a Google senior vice president, said at a technology conference last year.

Kaj, 20, confirms this: “If I’m looking for a restaurant or a museum or a place that I want to go, I’ll look it up on TikTok. It has a more organic feel rather than just looking it up on Google.” Amaria, 22, meanwhile, goes to TikTok to find new music because it’s “easier to figure out what you’re looking for” — and because “that’s usually where the trends start.”

Of course, these social media-fueled investigations go far beyond restaurant recs and playlist fodder. Zs are diving deep into the feed to decide whether or not to buy products of all kinds. “I always, always do my research. I go straight to TikTok before I click ‘Purchase,’” says Cristy, 19. Meanwhile, Kaj says, “Whether I’m getting a new phone or if I want an opinion on a company, I’ll look it up on TikTok.” Now, 70% of Zs say they only trust brands after they’ve done their own research on them.

Splintered Paths

This is just a snapshot of how the path to purchase splinters into a million directions, turning into a choose-your-own-adventure that’s unique to each Z. When deciding what to buy, their search for information may take them on a meandering path from TikTok to YouTube to Discord to Amazon — and even deep into the comments — to dig up the real dirt.

Consider 21-year-old Meezab’s personal path to purchase: “I’m always looking for inspiration. When I’m scrolling on TikTok just out of boredom, and I see an outfit I really like, I look in the comments. And I see if someone asks, ‘Where is this from?’ Then I’ll then go to Google and I’ll search what they said. And then I’ll see how much it is. I’m always looking for inspiration for what to buy.”

Meezab’s journey also makes an important point clear: While Inspire and Inquire may be two separate mindsets, Zs move seamlessly between the two. Mindless scrolling can lead to a spark of inspiration, which then triggers their more active mode of discovery and inquiry.

Meanwhile, conversion itself is far from linear for Gen Zs too. In our research, Zs repeatedly mentioned inspiration and inquiry leading to digital and literal shopping carts — but not necessarily to purchase. Instead of pulling the purchase trigger, Zs will collect and organize products into Pinterest boards, TikTok save folders, Amazon wish lists, and more. While 60% of Zs say they’ve made a wish list of products so they can buy them later (compared to 45% of Millennials), that number might be optimistic. Research shows that 80% of all online shopping carts, fail to make it to the checkout stage and 44% of Zs tell Archrival they’ve filled an online shopping cart with no intention of buying anything. It’s another example of how Gen Zs loop back and forth between Inspiration and Inquiry until they have all the information and incentive they need to hit ’buy.”

What it means for brands

Audit your brand — how are you serving both Zs’ Inspire Mindset and their Inquire Mindset? On the one hand, brands today must be aspirational, entertaining, and inspiring. On the flip side, brands need to build passionate communities who are actively unboxing, reviewing, and disseminating functional product info. Today, all brands must deliver on both.

Match consumers’ mindsets in the right moments. Now that you’ve developed distinct ways to engage consumers around Inspire versus Inquire, make sure to target the right messaging to the right mindset. Nothing is more of a turnoff for a Gen Z than a brand pushing its belief system when they’re looking for product info, or serving up product stats when they’re seeking inspiration.

Reimagine conversion as part of the journey, yet not always the final destination. Consider that the consumer journey now includes more pit stops and cul-de-sacs (Pinterest boards, TikTok save folders, Amazon wish lists, among others) where products may hang out for a bit before journeying on to purchase.